Discovery’s $2 billion purchase for all non-US television and digital rights of golf’s PGA Tour tournaments could create the largest single sport OTT offering, but why has the broadcaster decided to invest so much in the sport?

Creating a Netflix-style sports app into the broadcasting marketplace is something much talked about within the sports business industry for several years, but never achieved by anyone else on this scale. It’s ironic that Discovery is partnering on such a ground-breaking operation with a sport that still suffers from a 50+, mostly male demographic and a reputation for stuffiness and too much tradition.

However, Discovery President and CEO David Zaslav (a very keen golfer himself and the man who bought Eurosport in 2015) is keen to become an even bigger player in the world of sports.

At the same time, the PGA Tour (and the whole of the sport of golf) is desperate for a younger audience, so to have Tiger Woods and co available over 43 weeks per year on a near-worldwide streaming service means this is a match made in heaven.

At the announcement earlier this month, Zaslav highlighted that Discovery’s mantra is storytelling and that sport is the best kind of factual content, offering some of the most passionate tales that broadcasters can tell.

But while Zaslav admitted that it will not be simple to role out a series of successful international golf broadcasting deals, he also said: “We’re going to create a best-in-class, full-on eco-system for every golf fan in the world and this doesn’t have a requirement like the Olympics for certain events to be free-to-air.

“There are no rules here. We and the PGA Tour are all-in to build a global direct-to-consumer business and, if we thought it would help, we can launch a golf channel in every market or sell, for example, Saturday and Sunday rights to a local channel.

“We look at the FAANG companies and say ‘Wow, that’s awesome, the scale and the leverage of a global product’. Facebook, Amazon and Netflix are the only ones who have done this. The great thing about this partnership with the PGA is that it’s never been done before,” he said.

Discovery’s involvement with golf could create a perfect sporting situation - more eyeballs watching the sport should convert into more new golfers which, in turn, will mean more fans as well as more revenues for everyone in the golf industry. Plus, the very best players will not be lured away from the PGA Tour because prize money is almost certain to increase.

With the universally-popular Woods returning with such vigour to the PGA Tour and a raft of exciting young talent including over 80 non-US players from 25 countries, Discovery have picked an ideal moment to invest in the American golf scene. Tiger alone can increase viewing of live broadcasts in America by 200% and analysts believe that the audience numbers around the world are similar when the 14-time major champion is in the field.

With the 12-year deal starting in 2019, Discovery will build a whole new technology platform for its golf app and now has carte blanche to negotiate individually with over 200 different countries.

The first agreements are due for renewal next year in countries including Japan, Canada and Australia. The UK – a key market for revenue and awareness – will come up in 2022 along with India which is one of the several growing markets where Discovery hopes to cash in.

Each country-by-country deal can be tailored to the needs of the golf fans in that territory, but the as-yet-unnamed app will be heavily featured everywhere there is high-speed broadband with more traditional pay TV deals or even free-to-air access probably being a secondary option because Discovery sees sports broadcasting’s future in OTT platforms.

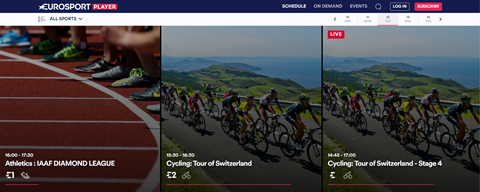

Its own Eurosport Player (currently in 54 markets) is now 10 years old, but was re-launched in 2015 (the year Discovery bought Eurosport) and really came into its own at this year’s Winter Olympics. Its major technical problems are now a thing of the past and the new golf app will benefit from all the Eurosport Player research and development.

But, technical issues aside, one country stands out as pivotal to the success of this partnership: China. If, as it’s anticipated, a male Chinese golfer breaks into the top 50 of the world rankings in the next few years and even wins on the PGA Tour, so all predictions for golf’s rise in global popularity will go through the roof.

“I’ve been working in China for 15 years. I have a good relationship with the Chinese government,” said Zaslav who is banking on heavy income from China.

Other Asian countries like Japan and South Korea (where fans are very smart about their smart phone apps already) will love streamed golf from year one, but if that one Chinese golfer emerges, then the size and scope of Discovery’s revenues will be almost incalculable.

However, Discovery will not wait for China’s potential to be fulfilled. The broadcaster’s commitment to the PGA Tour deal is total and will include between $20-30million of programming investment.

Zaslav said he wants to “make a great product which nourishes the golf enthusiast, the super fan, but not just the live TV of the tour. There will be golf teaching, short form content, interviews, the players’ family situation, news from behind the scenes, social news, and lots of extra content and revenue streams”.

Analyst Alexios Dimitropoulos of Ampere Analysis said that the PGA Tour has definitely struck a good deal for what is still a niche sport in many countries, while Discovery’s extra investment and their ability to promote their new product will be crucial to the overall success of the deal.

Also, the indication from European golf fans is that the app will be popular. “Across Europe, only 1.1% of consumers we survey are specifically interested in the PGA Tour with 3% overall enjoy watching golf,” says Dimitropoulos. “But almost 40% of those are willing to pay to watch their sport. That indicates a direct-to-consumer OTT opportunity - low fan numbers, but high willingness to pay. It’s like Formula 1 and the NBA in Europe.”

There will be a total of around 2,000 hours of live content for Discovery to sell highlighted by main PGA Tour events - such as The FedEx Cup, the Players Championship and also the Presidents Cup – but supplemented by around 100 smaller-scale regional tournaments including some in Canada, Latin America and China. All these events will be pushed out to vast new audiences at the expense of even the four majors, the World Golf Championships and also the Ryder Cup, none of which are owned by the PGA Tour.

In addition, this partnership has been signed amid the latest rumours of a world golf tour and the PGA Tour’s rights deal is just what any world tour would have wanted. So, the Tour and Discovery have undermined any immediate plans for a global golf operation while, at the same time, showing that they are now best placed to adopt that worldwide strategy at some time in the future.

This might look like a mega-deal for mega-bucks right now, but everyone in the sports broadcasting world is looking for ways to follow Netflix’s lead with an OTT product and, if this one works (and likely it will) then this PGA Tour-Discovery partnership will be just one of many more and could look like a real bargain.

No comments yet