The growing popularity of original video content and an increasing number of consumers paying for multiple streaming services are the central findings in the quarterly Voice of the Connected User Landscape (VoCUL) survey from 451 Research.

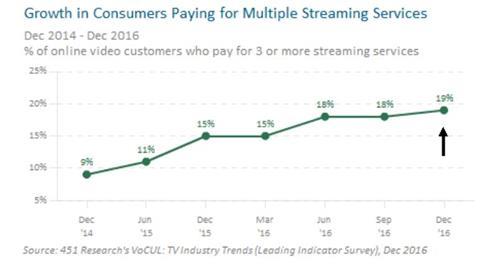

The survey found consumers are increasingly paying for three or more video streaming services, highlighting the trend for streaming video on demand (SVoD) that showcases original content.

This trend in the North American region illustrates that the investment content providers have injected into original content is paying off.

According to the survey, 19% of streaming subscribers now pay for three or more SVoD subscriptions, up four points from the previous year.

The streaming habits of consumers show they’re favouring customising their own video bundles, with Netflix ranking as the most popular SVoD channel at 95% and Amazon Video second at 82%. Platforms including Hulu, HBO Now and iTunes were among the other favourites.

Amazon Video continues to be the stand out platform accelerating rapidly – five points in the last year – with 53% of respondents subscribing to the streaming service, and 79% paying for Netflix.

‘Access to movies’ (50%) and viewing ‘complete seasons of TV shows’ (45%) were the two main reasons why consumers paid for streaming video services.

Importantly, 33% of streaming subscribers chose SVoD services for their ‘original content’, which has gone up eight points in the last year. The survey highlights the growing importance of original content, something that has always differentiated Netflix and Amazon from competitor streaming sites, HBO and Showtime, who broadcast on demand commercialised video content.

Viewers prefer à la carte TV

Research from Hub Entertainment confirms that US TV consumers favour a TV service model where they choose and pay for the networks they’re most interested in watching. “It has resulted in a new mindset among consumers, who have grown more and more accustomed to the idea that they shouldn’t have to pay for ‘extra’ that they never asked for in the first place,” says the report.

Over half of all respondents (53%) agreed an à la carte approach would be a preferable business model. Only 38% of consumers found the current model appealing. Some 68% of all respondents chose at least one SVoD service when asked to build their own TV package.

“This is an environment where SVoD—as aggregators with both original content and shows from other networks—provide especially good ‘bang for the buck” - Jon Giegengack, Hub Entertainment

Netflix versus Amazon

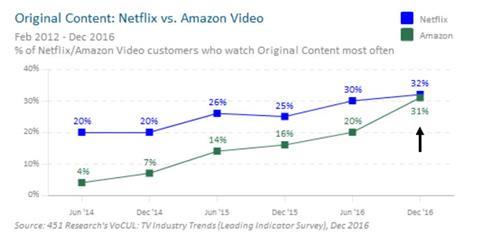

Consumers’ of both Netflix and Amazon streaming services are favouring watching original content over commercialised content, a trend that has shifted over the past two years.

There is a significant percentage growth in popularity with Amazon Video users watching original content on the SVoD site from 7% to 31%. The chart below illustrates the competition between Netflix and Amazon:

Andy Golub, Managing Director of 451 Research’s VoCUL end-user surveys and research, said original content produced by Amazon and Netflix show that the original video content is resonating with their customers.

“Original content has become a much more important factor over the past year in choosing streaming services, and the data shows consumers are simply watching more of it,” Golub said.

“Netflix and Amazon have spent billions creating exclusive original content to differentiate themselves within a competitive streaming TV market” – Andy Golub

Streaming devices

The 451 research VoCUL survey also looked at the streaming media device market, which continues to be ruled by Roku, Apple, Google and Amazon.

Roku leads with 31% of those surveyed who own a streaming media devices opting for a Roku streaming player and 10% a Roku Streaming Stick.

Apple TV is second at 35%, while Google Chromecast follows with 26%. Some 13% of respondents owned an Amazon Fire TV Stick and 10% an Amazon Fire TV.

No comments yet