European cinema attendance stood at 841 million in 2024, representing a slight 2% decline on the previous year, according to data from the European Audiovisual Observatory (EAO).

In the European Union, admissions were estimated at 640 million, down 3% from 2023.

In line with this trend, box office revenues are estimated to have reached €6.6bn in the wider European area (including the UK and Turkey), with €5bn generated in the European Union.

With figures stabilising near 2023 levels, the EAO said that cinema attendance appears to have settled at around 24% below pre-pandemic levels (2017–2019), suggesting that the post-pandemic rebound has run its course and that the market may have reached a new equilibrium.

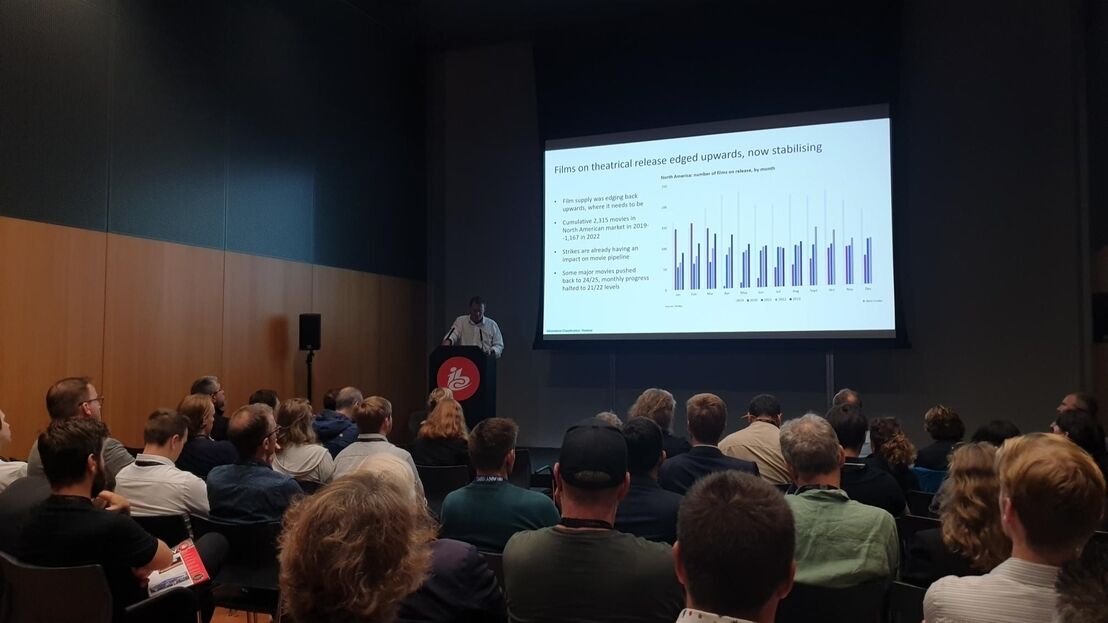

In 2024, the European theatrical sector continued to feel the impact of strikes in the North American film industry, which disrupted production and delayed releases, weighing on box office results. At the same time, however, national productions saw success in several European markets, making up for the shortfall of Hollywood titles.

Among the standout local films that reached the top of the charts in their national markets are A Little Something Extra, the most successful film in France in 2024 with over 10 million admissions; Gundi: Legend of Love, the all-time highest-grossing film in Bulgaria; and Stormskärs Maja, the top-grossing film in Finland post-pandemic.

Growth rates varied significantly across Europe; admissions ranged from a 13% decline in Norway to an 8% increase in Slovakia.

In terms of absolute numbers, France remained the leader in cinema attendance, with 181 million tickets sold, followed by the UK (127 million), Germany (90 million), and Italy (73 million).

Similar to 2023, Turkey and France recorded the highest shares of national film admissions, at 57% and 44%, respectively. Other notable national market shares were recorded in Czechia (31%), Finland (31%), and Serbia (26%).

Hollywood franchise films continued to dominate European box offices. Titles such as Inside Out 2, Despicable Me 4, Moana 2, and Deadpool & Wolverine were among the continent’s highest-grossing films.

You are not signed in

Only registered users can comment on this article.

Sky to offer Netflix, Disney+, HBO Max, and Hayu in one subscription

Sky has announced "world-first" plans to bring together several leading streaming platforms as part a single TV subscription package.

Creative UK names Emily Cloke as Chief Executive

Creative UK has appointed former diplomat Emily Cloke as its new Chief Executive.

Rise launches Elevate programme for broadcast leaders

Rise has launched the Elevate programme, a six-week leadership course designed to fast-track the careers of mid-level women working across broadcast media technology.

Andrew Llinares to step down as Fremantle’s Director of Global Entertainment

Andrew Llinares is to step down this spring from his position as Director of Global Entertainment at global producer and distributor Fremantle.

HBO Max to launch in UK and Ireland on March 26

Warner Bros. Discovery is to launch its streaming service HBO Max in the UK and Ireland on 26 March 2026.