With the barriers to entry to launching an OTT service coming down all the time, David Wood finds out how producers are going direct to market with niche offerings such as True Royalty.

Talk about online steaming services and most people immediately think of Netflix and Amazon Prime.

But having seen the big player’s phenomenal success with SVOD, most of the major content companies - from Disney to the BBC and NBCUniversal - are planning to join the SVOD party. For example, the BBC, ITV and C4 have re-ignited plans for a joint streaming service after the project failed to get off the ground after years of discussions.

It’s clear that in future Netflix and Amazon Prime will no longer have the territory to themselves with more rival services launching every month.

One reason for a surge in SVOD launches from content rights holders is that the financial barriers to start new services has plummeted.

As Toby Holleran, Senior Analyst at Ampere Analysis explains, the VOD market has changed markedly over the last decade.

“In the early days of streaming platforms, players would need to acquire or produce content, create a bespoke app and then organise how to distribute it, as well as finding a content delivery network to deliver the content, all of which had the potential to be a very costly process, especially as delivery costs were a lot higher back then.”

“Fast forward to today and content delivery costs have plummeted, and there are a range of different ways to enter the market to suit a wider range of players,” explains Holleran.

“Content owners do not have to produce their own app if they choose to launch exclusively on a particular distribution platform, a useful option for those who feel they may struggle to scale up quickly, or for those who do not have the funds to build an end-to-end SVOD service from scratch.”

SVOD suppliers can also offer their suite of content from within the on-demand packages of an established pay TV operator, Telco or broadcast-led on-demand service. For instance, TalkTalk has recently added Sony-backed kids service Hopster to its own kids package, as well as adding a suite of on-demand content from ABC.

Some of the most successful “niche” SVOD services typically have well established backing, and provide a suite of content not available elsewhere, he adds.

Two British content-focused services have made headway in the US – ITV and BBC joint venture Britbox and RLJ Entertainment-owned Acorn TV.

Ampere data suggests Britbox currently has around 370,000 subscribers, while Acorn has around double that. Acorn also launched an app on Comcast’s Xfinity boxes earlier this year, which has helped to drive growth.

In the UK, commercial network ITV has launched a subscription-based, ad-free version of its on-demand service ITV Hub (ITV Hub+) providing a range of ways for the broadcaster to develop new services and expand its subscriber base (currently around 100k), including allowing iOS users to download shows to their mobile devices and tablets to watch on the move.

SVOD also represents a big opportunity to smaller players such as UK independent Spun Gold, which has launched an SVOD service on the back of its productions about royalty.

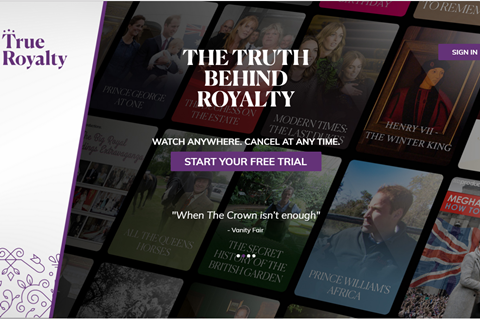

Founder Nick Bullen explains that there is an untapped market for content about all things royal, which Spun Gold aims to harness with its new, mainly factual SVOD service True Royalty.

“A few years ago the Royal shows we were making were sitting on the shelf probably never to be seen again after their first transmission, but now as the SVOD world explodes this content suddenly has value,” says Bullen.

True Royalty is available via the website TrueRoyalty.tv and on Google Chromecast, Amazon Fire Stick Apple Airplay and iOS and Android apps. CEO Gregor Angus says that part of the reason for the success of the proposition is its clarity.

“Nobody needs more than 11 seconds to understand what True Royalty is. People just get it, see what is there to watch and ask how much it costs (a seven day free trial and then £4.99/month in the UK.)

“It’s that fast,” says Angus, who insists: “Unless you are going the route of a general entertainment proposition such as Netflix or Amazon, the biggest single factor is to have a crystal clear proposition.”

“What really helps niche SVOD services is offering a very specific topic to a well-established interest group or groups, preferably viewers which have already grouped themselves into communities and can be reached easily and efficiently rather than an SVOD service hanging around somewhere in the middle of the Pacific looking for an audience.”

“What we are doing with True Royalty is building a roadmap, defining who our viewers really are, where they might find us and how we can get them to subscribe,” says Angus. “We might reach viewers through a smartphone app first, but we know they are much more likely to subscribe later through tablet or laptop.”

Strategies for customer acquisition and retention are likely to vary from territory to territory as does the list of potential partner platforms who we might want to get involved with, says Angus. “For instance, Roku might be a big deal in the USA but in other market other platforms might make more sense.”

“Before negotiating with TV operators or an OTT aggregator we are trying to create our own brand and stand on our own two feet,” he advises. “That way we can prove that there is genuine interest in the service and it puts us in a much stronger negotiating position.”

“Our aim is certainly not to roll out across every platform overnight,” adds Angus. He advises content owners readying SVOD offerings to “keep your cost base low. We have a huge advantage in that our content is on the one hand very premium and on the other, not that expensive to produce.”

So far True Royalty’s route to market has been “very aggressive”, says Angus, starting out with an MVP [minimum viable product]. “Our immediate focus was on the major platforms and devices most people use: web (HTML5), iOS and Android mobile and tablets and casting on Chromecast and Airplay. Next we plan to scale up across streaming boxes (Apple TV, Roku) and porting those code bases into Smart TV platforms (Android TV, Samsung, Foxxum). We are also setting up porting capability into third party services such as Amazon Channels and Comcast.

“The Royal shows we were making were sitting on the shelf probably never to be seen again after their first transmission, but now as the SVOD world explodes this content suddenly has value.” Nick Bullen, Spun Gold

For content owners such as German kids content producer and rights holder M4E the attraction of SVOD is increasing through partnership with OTT giant YouTube. As Ulli Stoef, M4E CEO, explains: “It’s incremental business and extra revenues for us. We have a back library of 17,500 episodes of kids shows only 30-40% of which we are able to actively market.”

OTT offers subscribers access to the back library which you can make money from either with advertising VOD or subscription VOD.”

M4E is actively exploring the potential of SVOD with deals with YouTube as a certified YouTube partner. “It helps generate millions of views on the platform, which can be monetised, plus we can use the online platform as a marketing tool for our library of kids and family entertainment. We are also developing a new platform made4kids tv on YouTube.

“For us, SVOD has a lot of potential, with none of the onerous cable or satellite transmission costs,” says Stoef. “It’s a much more cost effective way to grow the business.”

No comments yet