Paramount has signed a seven-year media rights agreement with sports and entertainment company TKO to become the exclusive home of all Ultimate Fighting Championship (UFC) events in the US.

Paramount has signed a seven-year media rights agreement with sports and entertainment company TKO to become the exclusive home of all Ultimate Fighting Championship (UFC) events in the US.

The seven-year term reportedly has an average annual value (AAV) of US$1.1bn (GBP£860m). Currently, UFC mixed martial arts (MMA) events take place year-round with approximately 43 live events annually, delivering more than 350 hours of live event content. In the US, UFC has approximately 100 million fans who are engaged across linear, digital and social platforms. Further, has programming reaching nearly 950 million broadcast and digital households across more than 210 countries and territories in 50 languages, as well as a roster of approximately 600 male and female MMA athletes representing 75 countries.

Rokas Tenys

Starting in 2026, Paramount will exclusively distribute UFC's full slate of 13 marquee numbered events and 30 Fight Nights via its direct-to-consumer streaming platform, Paramount+ with select numbered events to be simulcast on CBS, Paramount's broadcast network.

As part of the agreement, UFC and Paramount will move away from UFC's existing pay-per-view model in favour of making these premium events available at no additional cost to the US subscriber base of Paramount+. This shift in distribution strategy is expected to unlock greater accessibility and discoverability for sports fans. It is also projected to drive engagement and further subscriber growth for Paramount+. Additionally, Paramount has stated its intention to explore UFC rights outside the US as they become available in the future.

Paramount Chairman and CEO David Ellison highlighted: "I couldn't be more excited to join forces with Dana, Ari, and Mark. Rarely do opportunities arise to partner on an exclusive basis with a global sports powerhouse like UFC – an organisation with extraordinary global recognition, scale, and cultural impact. Paramount's advantage lies in the expansive reach of our linear and streaming platforms. Live sports continue to be a cornerstone of our broader strategy – driving engagement, subscriber growth, and long-term loyalty, and the addition of UFC's year-round must-watch events to our platforms is a major win. We look forward to delivering this premium content to millions of fans in the US, and potentially beyond."

TKO Executive Chair and CEO Ariel Emanuel commented: "This is a milestone moment and landmark deal for UFC, solidifying its position as a preeminent global sports asset. Our decade-long journey with UFC has been defined by continuous growth and expansion, and this agreement is an important realisation of our strategy. We believe wholeheartedly in David's vision and look forward to being in business with a company that will prioritise technology as a means to enhance storytelling and the overall viewing experience."

TKO president and COO Mark Shapiro added: "Paramount is a platinum partner with significant reach. Our new agreement unlocks powerful opportunities at TKO for years to come – meaningful economics for investors, expanded premium inventory for global brand partners, and deeper engagement for UFC's passionate fanbase. Just as importantly, our athletes will love this new stage."

Skydance Media and Paramount Global recently completed their long-planned $8.4bn merger. Discover more here.

John Gore Studios acquires AI production specialist Deep Fusion

UK-based film and TV group John Gore Studios has acquired AI specialist production company Deep Fusion Films.

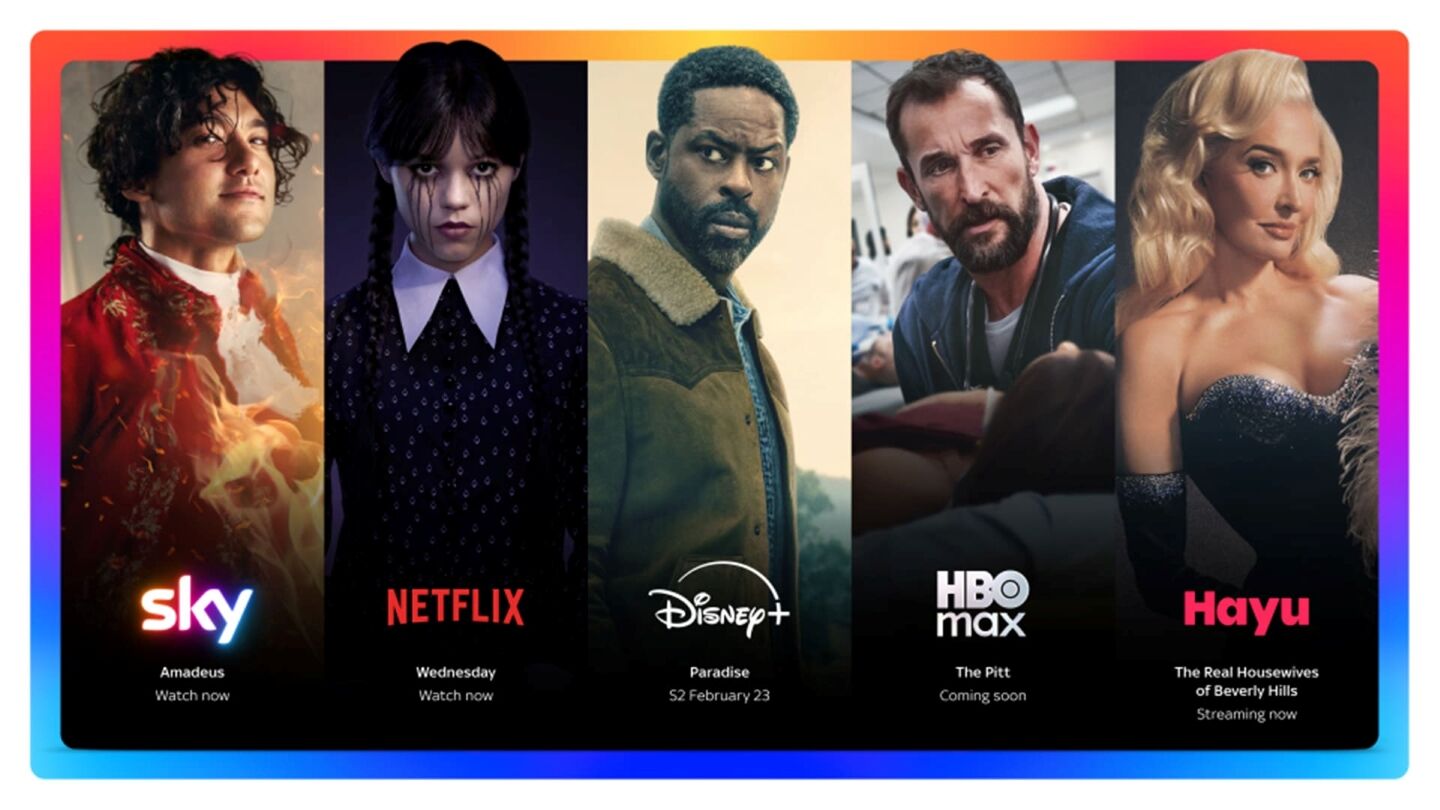

Sky to offer Netflix, Disney+, HBO Max, and Hayu in one subscription

Sky has announced "world-first" plans to bring together several leading streaming platforms as part a single TV subscription package.

Creative UK names Emily Cloke as Chief Executive

Creative UK has appointed former diplomat Emily Cloke as its new Chief Executive.

Rise launches Elevate programme for broadcast leaders

Rise has launched the Elevate programme, a six-week leadership course designed to fast-track the careers of mid-level women working across broadcast media technology.

Andrew Llinares to step down as Fremantle’s Director of Global Entertainment

Andrew Llinares is to step down this spring from his position as Director of Global Entertainment at global producer and distributor Fremantle.