France’s Canal+ has moved a step closer to taking over African pay-TV giant MultiChoice.

The South African Competition Tribunal has approved the deal, subject to “agreed conditions,” which include maintaining local funding for South African general entertainment and sports content and providing local creators with opportunities.

The two companies said in a statement via the Johannesburg Stock Exchange, where Multichoice is listed, that they are on track to complete the deal before 8 October 2025.

Canal+, which already owns over a third of MultiChoice, is due to pay 35bn rand ($2bn) to acquire the business.

Maxime Saada, CEO of CANAL+, said: “The approval by South Africa’s Competition Tribunal marks the final stage in the South African competition process and clears the way for us to conclude the transaction in line with our previously communicated timeline. It is a hugely positive step forward in our journey to bring together two iconic media and entertainment companies and create a true champion for Africa.”

Calvo Mawela, CEO of MultiChoice Group, said: “The announcement marks a significant milestone and is a major step forward for both companies. It reflects the strength of our strategic vision and our ongoing commitment to continue uplifting the communities where we operate. We look forward to executing the remaining processes required to complete the transaction and to start building something extraordinary: a global media and entertainment company with Africa at its heart.”

.jpg)

BSC Expo: “AI is a real b*****d to work with”

The annual British Society of Cinematographers (BSC) Expo returned to the Evolution Centre in Battersea, London, this weekend, attracting key professionals across the production industry with its packed seminar schedule and frank discussions on the future of the film industry.

John Gore Studios acquires AI production specialist Deep Fusion

UK-based film and TV group John Gore Studios has acquired AI specialist production company Deep Fusion Films.

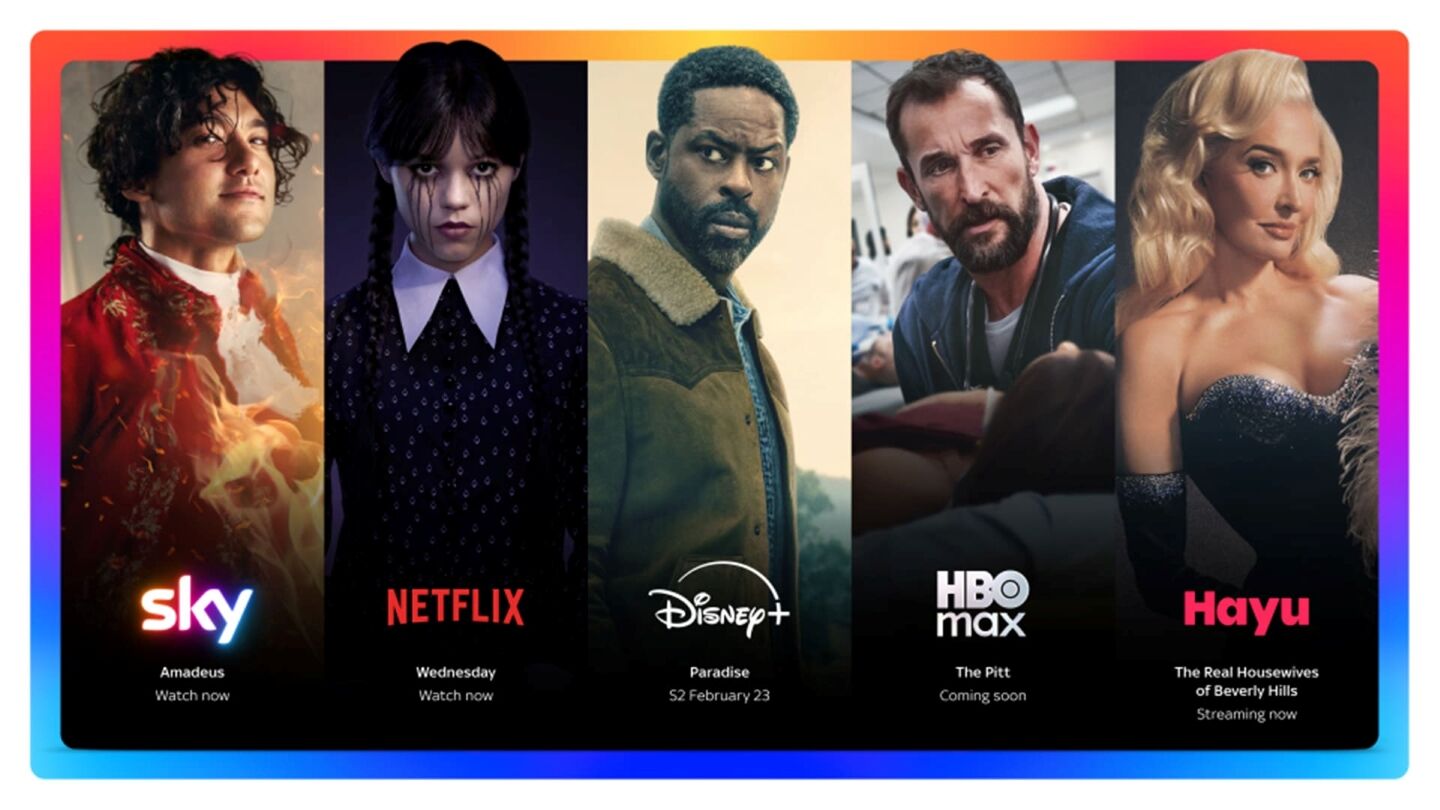

Sky to offer Netflix, Disney+, HBO Max, and Hayu in one subscription

Sky has announced "world-first" plans to bring together several leading streaming platforms as part a single TV subscription package.

Creative UK names Emily Cloke as Chief Executive

Creative UK has appointed former diplomat Emily Cloke as its new Chief Executive.

Rise launches Elevate programme for broadcast leaders

Rise has launched the Elevate programme, a six-week leadership course designed to fast-track the careers of mid-level women working across broadcast media technology.