Households with children are less likely to cancel streaming service subscriptions than those without them, according to new research from Ampere Analysis.

As a result, streamers are scooping up kids’ titles to appease the influential kids audience in a bid to retain subscribers and to reduce churn.

However, children and family titles have been among the most affected by the global slowdown in commissioning experienced between 2022 and 2023. The number of children and family TV titles announced during that time fell by 15% globally.

VoD original children’s TV titles decreased by 18% between 2022 and 2023, but well-funded public broadcasters have provided more consistent opportunities for the creation of children’s content, especially in Western Europe.

Given the reduction in original children’s content in the market, Ampere concluded that those who can fund their own new children’s titles will have an advantage in a busy acquisition market.

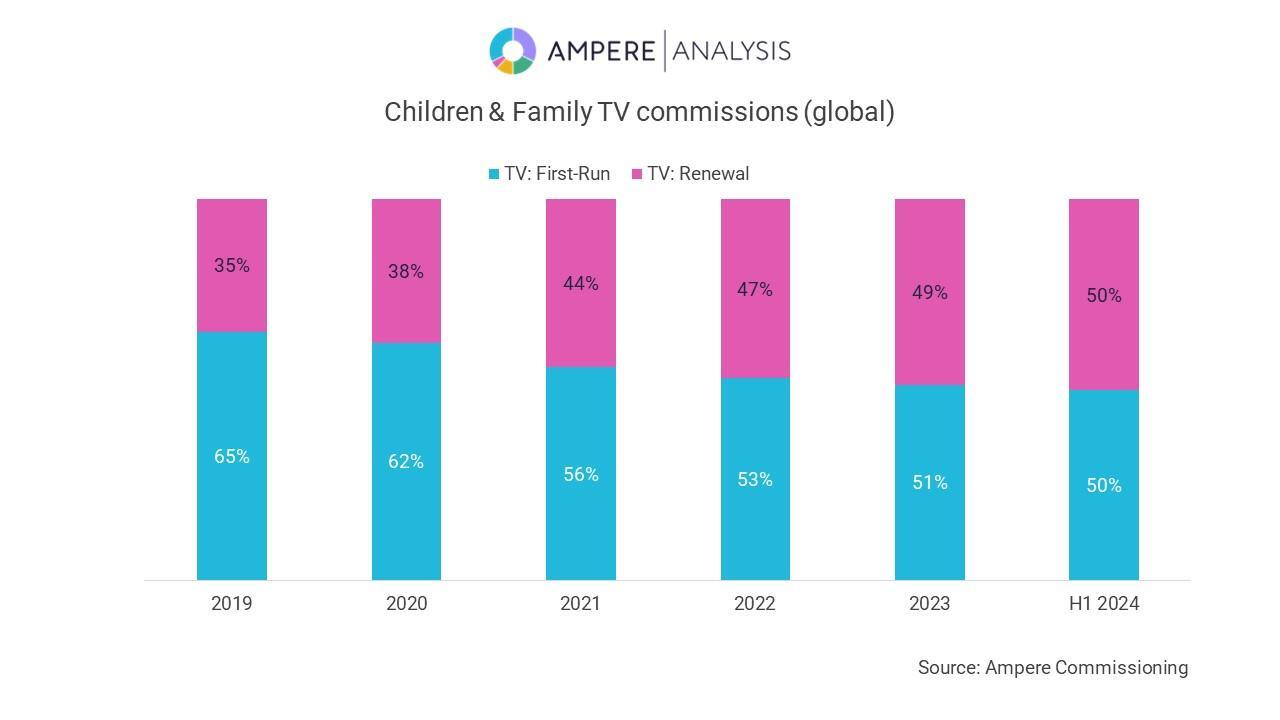

Ampere said that children’s content based on existing ideas has also proven to be more robust during the global slowdown. Children’s book adaptations fell by just 9% between 2022 and 2023 versus a 15% decline in all global children’s TV content over the same period. Half of all children’s titles announced in the first half of 2024 were renewals.

Olivia Deane, Research Manager at Ampere Analysis said: “A global decline in commissioning caused by slowed growth in the streaming market poses a range of challenges to children’s content. Children & Family titles were the third most affected by this slowdown between 2022 and 2023. They were behind only the more expensive genres of Drama and Crime & Thriller. Those who can find independent funding, especially for titles based on existing intellectual property with reliable audience appeal, will have an advantage in a busy acquisitions market.”

You are not signed in

Only registered users can comment on this article.

WBD mails definitive proxy statement to finalise Netflix merger

Warner Bros. Discovery (WBD) will hold a special meeting of shareholders to vote on the merger with Netflix on March 20, 2026. In the meantime, WBD has begun mailing the definitive proxy statement to shareholders for the meeting.

Sky's talks to acquire ITV slow down

Talks by Sky to acquire ITV’s broadcast channels and streaming platform have slowed in recent weeks, according to a report by Reuters.

Bytedance pledges to rein in Seedance AI tool

Chinese technology giant ByteDance has pledged to curb its controversial artificial intelligence (AI) video-making tool Seedance, following complaints from major studios and streamers.

Digital switch-off prospect nullifies Arqiva’s value

Arqiva’s main shareholder has admitted that its holding of the transmission company might be worth nothing.

Warner Bros Discovery mulls re-opening sales talks with Paramount

Warner Bros Discovery is considering reopening sale talks with Paramount Skydance Corp, according to a Bloomberg report.

.jpg)