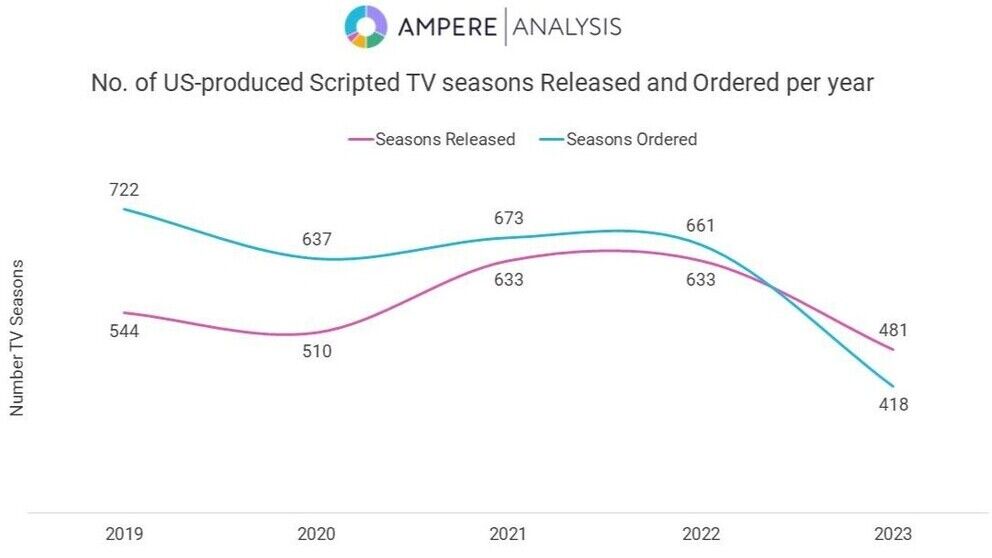

The number of scripted US series releases fell to 481 in 2023 as a result of strike action and a downturn in the original content boom, according to new figures from Ampere Analysis.

This figure is below the 510 series released during COVID-hit 2020, and well below 2021 and 2022 when the figure was 633 series - the pinnacle of the Peak TV trend.

Ampere said that SVoD services released 77 fewer seasons in 2023, and broadcast TV released 55 fewer seasons.

Broadcast TV releases have been falling slowly for many years, but the drop in 2023 can mostly be blamed on the strikes which delayed the launch of many new scripted seasons on broadcast TV.

The more fundamental decline can be traced to SVoD services. Netflix reduced its releases from 107 in 2022 to just 68 in 2023, according to Ampere, which explained that the drop began in the first half of the year, so cannot be blamed on strike action. Other big reductions were from Peacock (-20 titles) Hulu (-11), Max (-9), and Paramount+ (-4).

Ampere also noted that US commissions are now outnumbered by international commissions at the SVODs.

There were 202 new US commissions in 2023 (down from 342) by the top eight SVODs versus 295 international (down from 429) - a disparity of 46%.

Ampere said the strikes are partly the cause but also cited the internationalisation of the industry and the decentring of Hollywood as the core of the world’s TV business.

Fred Black, Principal Analyst at Ampere Analysis, said: “A combination of disruptive strike action, a tightening of purse strings at SVoD services, and the relative bang-for-your-buck offered by international production markets, in terms of costs, fresh content, and potential subscriber growth, saw the US scripted boom finally run out of steam. While 2024 will see some level of a bounce back in the content being ordered, many of these titles will be released in 2025, meaning any recovery is likely to be slow going.”

You are not signed in

Only registered users can comment on this article.

WBD mails definitive proxy statement to finalise Netflix merger

Warner Bros. Discovery (WBD) will hold a special meeting of shareholders to vote on the merger with Netflix on March 20, 2026. In the meantime, WBD has begun mailing the definitive proxy statement to shareholders for the meeting.

Sky's talks to acquire ITV slow down

Talks by Sky to acquire ITV’s broadcast channels and streaming platform have slowed in recent weeks, according to a report by Reuters.

Bytedance pledges to rein in Seedance AI tool

Chinese technology giant ByteDance has pledged to curb its controversial artificial intelligence (AI) video-making tool Seedance, following complaints from major studios and streamers.

Digital switch-off prospect nullifies Arqiva’s value

Arqiva’s main shareholder has admitted that its holding of the transmission company might be worth nothing.

Warner Bros Discovery mulls re-opening sales talks with Paramount

Warner Bros Discovery is considering reopening sale talks with Paramount Skydance Corp, according to a Bloomberg report.