Tech market analysts Omdia reveal their latest findings that show a significant shift in the connected TV (CTV) market with hardware manufacturers increasingly capitalising on platform revenues rather than hardware sales. Companies such as Roku and Vizio are even accepting losses on hardware to focus on more lucrative revenue streams from their platforms.

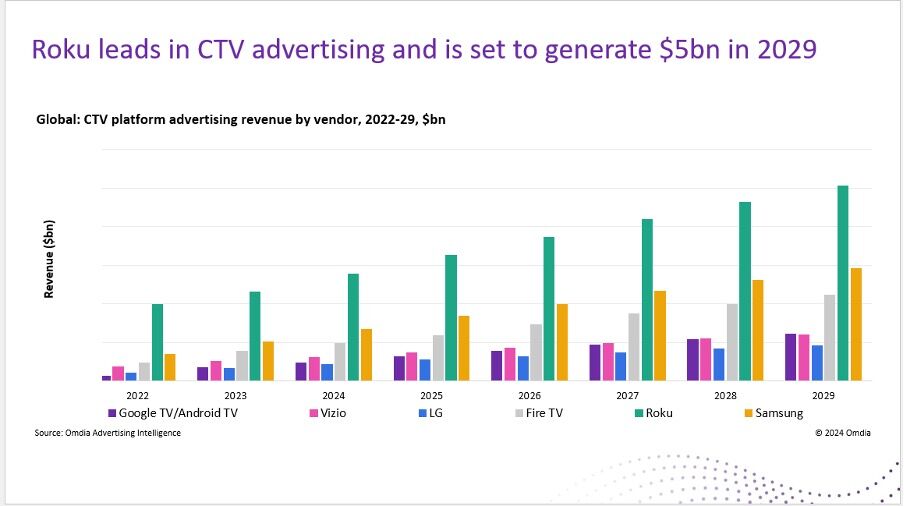

Roku is at the forefront of the CTV advertising space, with projections indicating it will generate $5 billion in revenue by 2029. This forecast includes income from Free Ad-Supported Streaming TV (FAST), CTV user interface ads, and third-party inventory shares.

Roku’s dominance in CTV advertising is expected to drive the industry, which is forecasted to double by 2029 compared to 2024 levels. Currently, Roku is the leading CTV player in the US, the world’s largest advertising market, with 20% of US TV sets powered by its platform, enhancing its advertising success and setting a benchmark for competitors.

Samsung, the second-largest player in the CTV market, is also anticipated to see substantial growth, with revenues projected to reach $3 billion by 2029 - more than doubling from $1.35 billion in 2024. Samsung’s extensive global presence enables it to maintain strong competition with Roku, despite Roku’s dominance in the largest advertising market.

Walmart’s acquisition of Vizio highlights its strategic move to tap into the expanding CTV revenue streams, with plans to explore new avenues such as retail media and shoppable TV in the U.S., indicating shifts in the competitive landscape.

The total CTV advertising market is set to grow from $6.65 billion in 2024 to $13.5 billion by 2029, with Roku expected to lead this expansion, projecting revenues of $2.8 billion in 2024 and rising to $5.1 billion by 2029.

“Roku’s success is driven by its position as the largest platform in the top advertising market, while Samsung maintains strong competition through its broad international reach,” said Maria Rua Aguete, Senior Research Director, in Omdia’s Media and Entertainment practice. “As the CTV advertising market is set to double, both Roku and Samsung are strategically positioned to leverage this explosive growth.”

Watch Maria Rua Aguete’s sessions at IBC2024 in Amsterdam which delve into the key drivers of growth in the media and entertainment market, the rise of streaming video, evolving advertising business models, and the impact of AI on the industry.

You are not signed in

Only registered users can comment on this article.

WBD mails definitive proxy statement to finalise Netflix merger

Warner Bros. Discovery (WBD) will hold a special meeting of shareholders to vote on the merger with Netflix on March 20, 2026. In the meantime, WBD has begun mailing the definitive proxy statement to shareholders for the meeting.

Sky's talks to acquire ITV slow down

Talks by Sky to acquire ITV’s broadcast channels and streaming platform have slowed in recent weeks, according to a report by Reuters.

Bytedance pledges to rein in Seedance AI tool

Chinese technology giant ByteDance has pledged to curb its controversial artificial intelligence (AI) video-making tool Seedance, following complaints from major studios and streamers.

Digital switch-off prospect nullifies Arqiva’s value

Arqiva’s main shareholder has admitted that its holding of the transmission company might be worth nothing.

Warner Bros Discovery mulls re-opening sales talks with Paramount

Warner Bros Discovery is considering reopening sale talks with Paramount Skydance Corp, according to a Bloomberg report.

.jpg)