Reports

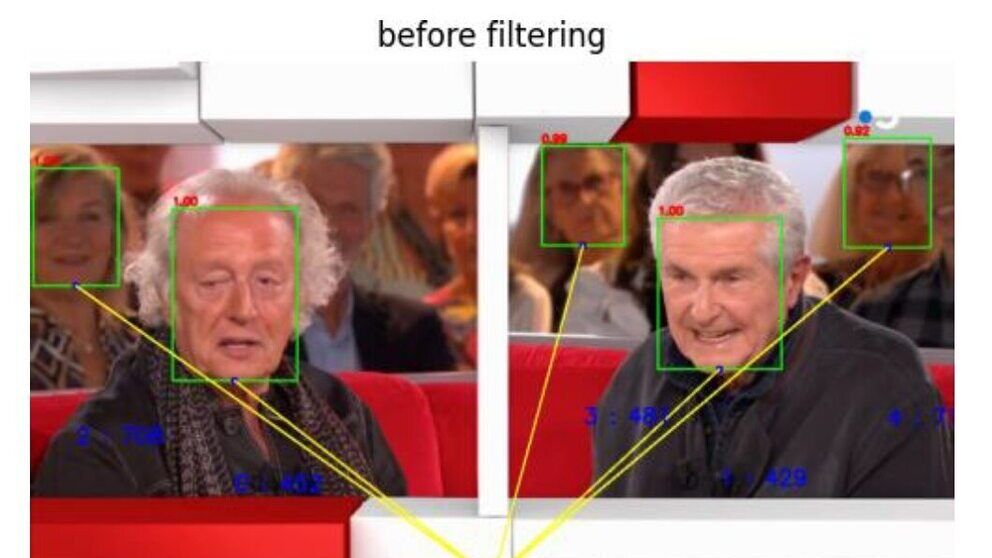

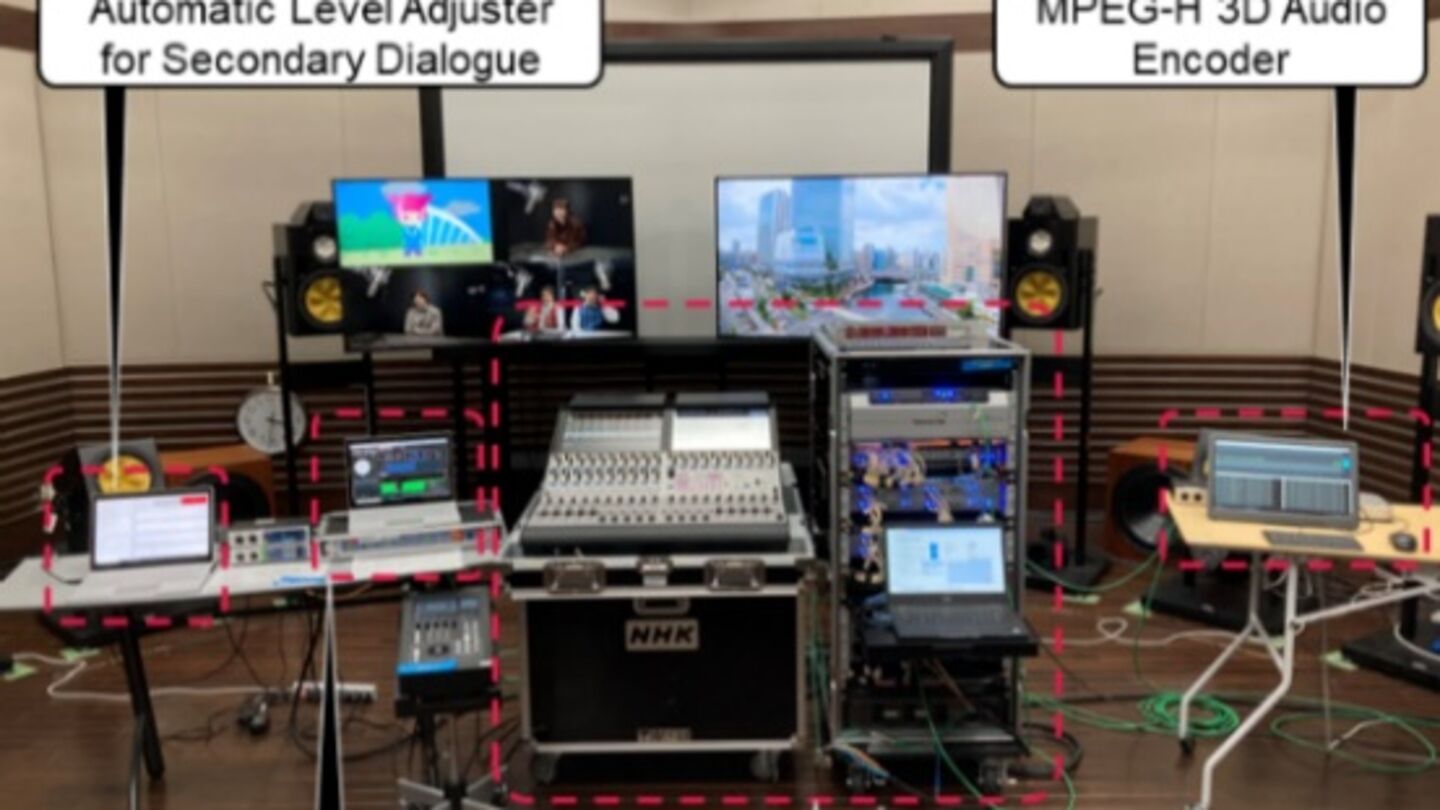

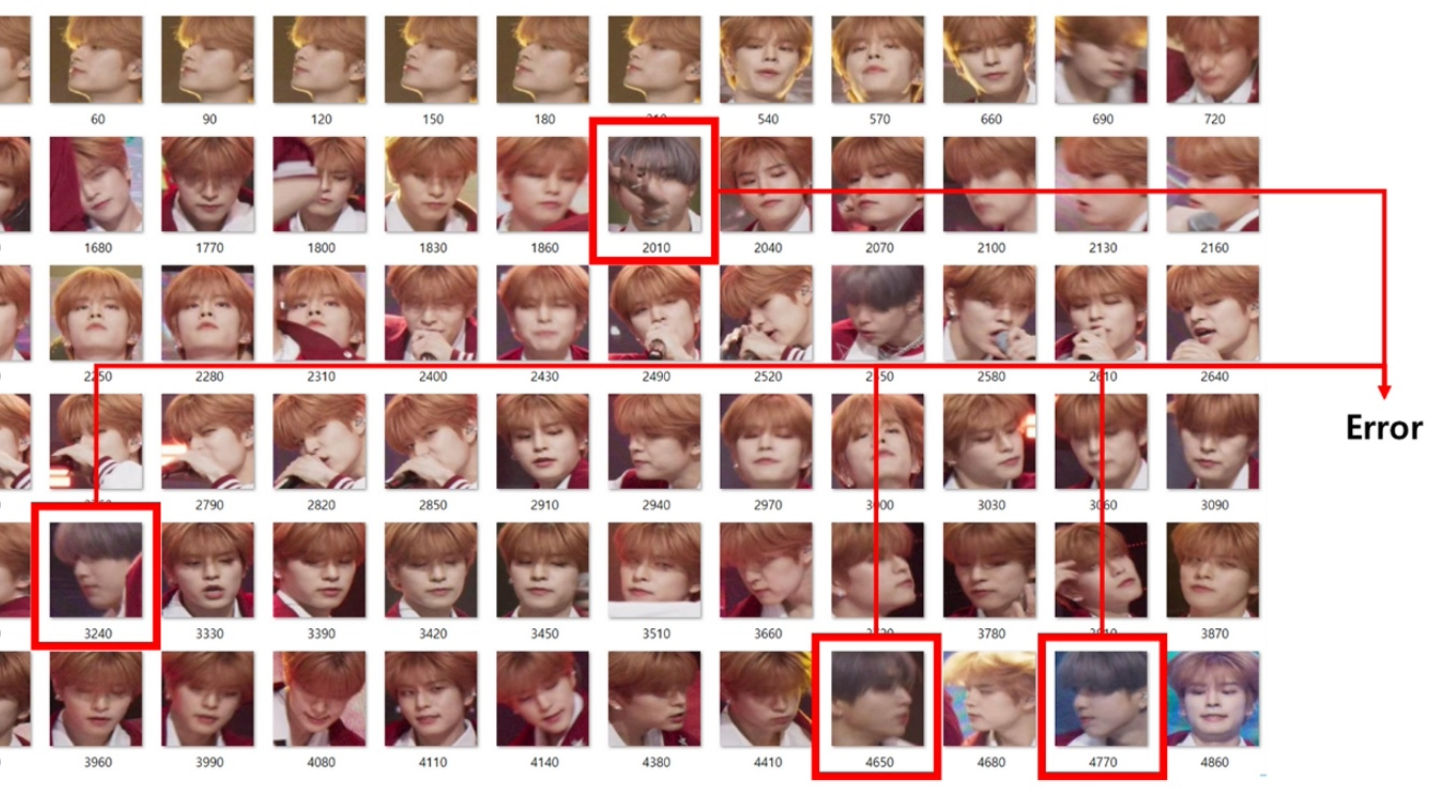

Demonstration of AI-based fancam production for the Kohaku Uta Gassen using 8K cameras and VVERTIGO post-production pipeline

Reports

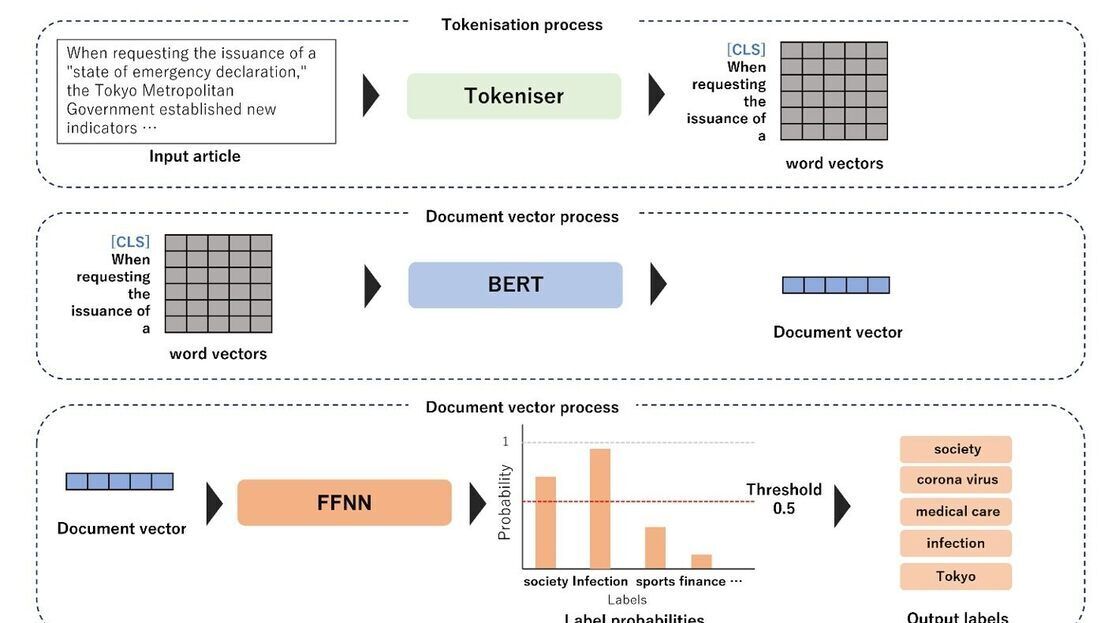

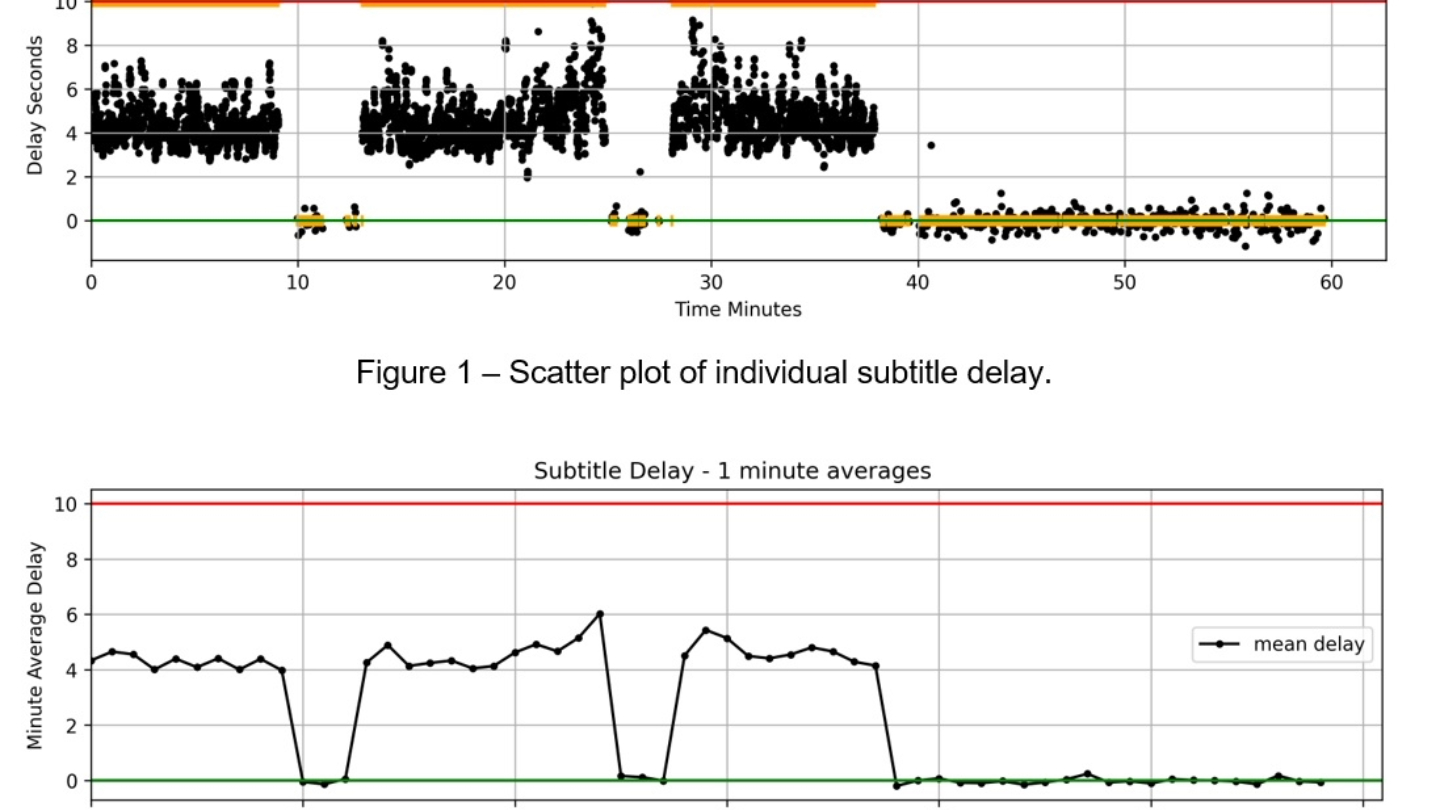

Using generative AI-speech-to-text output to provide automated monitoring of television subtitles

Reports

.jpg)

.jpg)