The major global streaming platforms will invest $42bn in original and acquired film and TV content in 2023, according to research by Ampere Analysis.

This marks a slower combined rate of growth for streamers Netflix, Amazon Prime Video, Disney+, Apple TV+, Paramount+ and Max/HBO Max of 7% year-on-year, compared to the 24% growth in streaming spending witnessed in 2022.

Ampere said that, amid intense competition and a challenged global economy, the SVoD platforms will prioritise cost management and effective content acquisitions to thrive in 2024 and beyond.

Of the $42bn in SVoD content spend dedicated to TV series and films, 90% is for scripted.

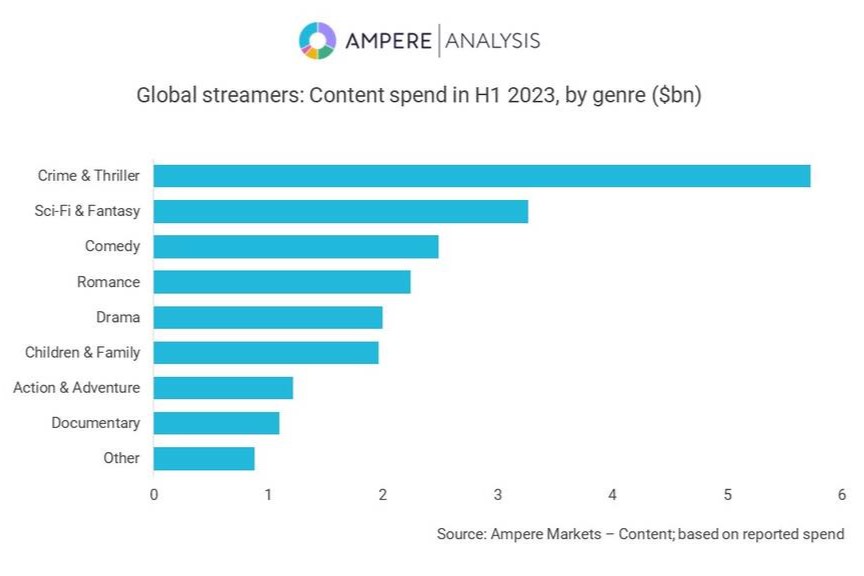

Crime & thriller tops SVoD spending, with investment expected to hit $12bn this year. The sci-fi & fantasy and comedy genres also command substantial funds.

At a platform level, Ampere said that Netflix and Amazon Prime Video are adopting a balanced approach to genre allocation, leveraging their scale to cater to the preferences of diverse demographics.

Other SVoD players are pursuing more targeted spending strategies, focusing on key genres and IP to cultivate subscriber bases. Apple TV+ dedicates 40% of its budget to crime & thriller titles, building on past successes such as Slow Horses and Severance. Disney+ has prioritised sci-fi & fantasy and children & family genres, anchored by TV spin-offs from the Star Wars, MCU and Pixar franchises.

Ampere said that streamers are increasingly turning to entertainment and reality as their budgets tighten and they search for subscriber engagement at a lower cost. Spending on unscripted content by SVoD platforms is set to hit $4.9bn this year, growing by 22% year-on-year, vastly outpacing the overall rise in spending by global streamers. An initial focus on documentaries has expanded to encompass entertainment and reality, with a particular focus on both producing and acquiring dating, talk show and game show formats.

Neil Anderson, Senior Analyst at Ampere Analysis, said: “In 2023, we forecast that major global SVoD platforms will collectively invest $42bn in film and TV content. The moderated spending growth rate in comparison to previous years underscores the maturity of the SVoD market and the importance of strategic spending across genres. At $15 billion, Netflix will retain its position as the top investor in global streaming content, albeit with a modest 2% increase. Meanwhile, rivals such as Disney+, Paramount+, and Apple TV+ are poised for more substantial budget expansions, projecting year-on-year increases exceeding 10%.”

You are not signed in

Only registered users can comment on this article.

UK film and TV industry backs clean power plan

The UK film and TV industry has agreed on a plan to permanently shift to clean solutions for temporary power on sets.

Nigel Warner to succeed John McVay as CEO of Pact

UK producers' body Pact has named Nigel Warner, UK Policy Consultant to the Motion Picture Association and Special Counsel at Lexington, as its next CEO.

Sky’s Priya Dogra to become Chief Executive of Channel 4

Priya Dogra will become the next Chief Executive of Channel 4. Currently Chief Advertising, Group Data, and New Revenue Officer at Sky, Dogra will succeed interim Jonathan Allan in March 2026.

One Battle After Another, The White Lotus, and Adolescence lead Golden Globe nominees

One Battle After Another, The White Lotus, and Adolescence have emerged as the frontrunning films and TV shows for the 2026 Golden Globes.

President Trump weighs in on Netflix deal to buy Warner Bros Discovery

US President Donald Trump has added his voice to concerns about Netflix's planned $83bn deal to buy Warner Bros Discovery.